Companies in these sectors consequently tend to experience earnings peaks and valleys that fall in line with economic cycles. Additionally, dividend reductions are viewed negatively in the market and can lead to stock prices dropping (2). For instance, federal sales tax deduction insurance company MetLife (MET) has a payout ratio of 72.3%, while tech company Apple (AAPL) has a payout ratio of 14.6%. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

In what ways does the dividend payout ratio differ from the dividend yield?

The dividend payout ratio signifies the percentage of earnings paid to shareholders as dividends. In contrast, dividend yield represents the percentage of a company’s share price paid out in dividends annually. Investors also pay attention to dividends per share, which help them evaluate the actual cash return they receive per unit of stock owned.

Which of these is most important for your financial advisor to have?

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. By contrast, a company with adequate liquid resources may distribute a larger portion of its profits to shareholders. IVT has a payout ratio of 993.3% which is higher than the Real Estate sector, the industry and its peers average. In comparison with the Real Estate sector average of 122.3%, InvenTrust Properties’s payout ratio is 712% higher. IVT has a dividend yield of 2.89% which is lower than the Real Estate sector, the industry and its peers average. If we compare it with the Real Estate sector average of 5.86%, InvenTrust Properties’s dividend yield is 51% lower.

Dividend Payout Ratio and Share Repurchases

A low payout ratio is not inherently better than a high one, as it depends on the investor’s objectives and the specific company. A low payout ratio suggests that a company is retaining more earnings for growth and reinvestment, which might be attractive to growth investors. On the other hand, a high payout ratio may be appealing to income-oriented investors seeking regular dividend income. Companies with the best long-term records of dividend payments generally have stable payout ratios over many years. But a payout ratio greater than 100% suggests that a company is paying out more in dividends than its earnings can support. Of note, companies in older, established, steady sectors with stable cash flows will likely have higher dividend payout ratios than those in younger, more volatile, fast-growing sectors.

When a company pays out some of its earnings as dividends to shareholders, the remaining portion is retained by the business. For financial analysts, this ratio is a key component in a broader analysis of a company’s financial health, performance, and long-term strategy. It can influence investment decisions and is often compared across industries to gauge sector performance. Tax policies and regulations play a significant role in determining the dividend payout ratio. In certain jurisdictions, companies may adjust their dividend policies to optimize tax efficiency for both the company and its shareholders. These considerations can impact the ratio and influence dividend distribution decisions.

Why You Can Trust Finance Strategists

It is the guiding principle driving the decision of whether, when, and how much dividend should be paid out of profits. A careful analysis of earnings per share and the company’s sustainable growth objectives enables management to determine an appropriate payout ratio. For instance, a company may decide to maintain a lower payout ratio if it is focused on reinvestment strategies for future growth, indicating to growth investors the potential for significant returns on their investment. The payout ratio is the percentage of a company’s earnings allocated to pay dividends to shareholders. It signifies the portion of earnings distributed in the form of dividends, offering an insight into a company’s dividend policy and financial prudence. A sustainable payout ratio indicates a balance between distributing profits to shareholders and retaining funds for future growth.

It has declared an interim dividend of S$0.015 per share against an earnings per share of S$0.09 for the first half of FY2025 to September, translating to a payout ratio of 16.7 per cent. Consequently, the decision to invest in a company is based on the extent of an investor’s belief that the stock is likely to pay dividends and/or appreciate in share price. While the unreasonably high DPR may spur the interest of some investors, most will view it as unsustainable. Nevertheless, investors generally lose confidence in companies that reduce dividends, “punishing” them by selling off shares and driving the share price further down. Nevertheless, a company may be able to survive a couple of less profitable years without suspending its dividends to help maintain the confidence of its shareholders and the market in general. Following a stock’s dividend long-term trends provides additional insight into whether a company’s performance is growing, declining or stable–along with the level of historical safety or volatility of its dividends.

Another variation of the dividend payout ratio is calculated on a per-share basis. As a result, it is critical to figure out if a company is paying out a reasonable portion of earnings in dividends so that the level can be comfortably sustained–or even raised–over time. Legal and regulatory frameworks, such as dividend restrictions imposed by debt agreements or government regulations, can also influence a company’s dividend payout ratio. These factors need to be taken into account when determining the appropriate dividend distribution level.

The ideal dividend payout ratio varies depending on factors such as industry norms, company size, growth stage, and financial health. Generally, a ratio between 30% to 50% is considered healthy, as it allows for both dividend payments and retained earnings for reinvestment. However, it is important to compare ratios within the same industry and consider the company’s specific circumstances.

- Similarly, companies paying higher dividends tend to be in well-established mature industries with stable earnings and little room for additional growth, where paying higher dividends may be the best use of profits.

- Learn more about planning and maintaining a happy, financially secure retirement.

- Companies in these sectors consequently tend to experience earnings peaks and valleys that fall in line with economic cycles.

- Conversely, shareholders may advocate for a lower payout ratio if they believe reinvestment can drive future growth and create long-term value.

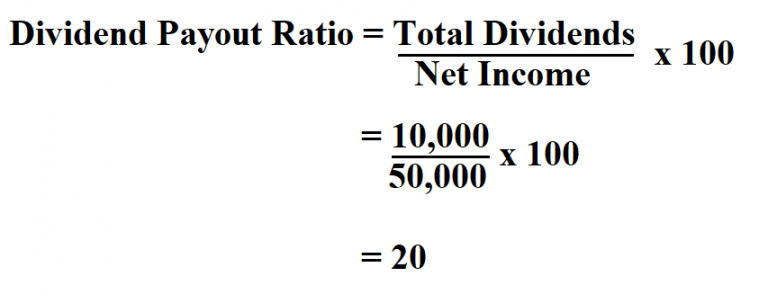

To calculate the dividend payout ratio, the formula divides the dividend amount distributed in the period by the net income in the same period. Companies in defensive industries such as utilities, pipelines, and telecommunications tend to boast stable earnings and cash flows that can support high payouts over the long haul. Income-driven investors have been advised to look for a ratio in the neighborhood of 60%, however. On rare occasions, a company may offer a dividend payout ratio of more than 100%.

As an example, when the DPR has continuously decreased for the last 3-5 years, it could mean that a company may find it difficult to maintain such a high level of dividend in the future. A zero or low ratio means that a company is either using all of its net income to grow its business or does not actually have any earnings to distribute. Of course, a business can only continue paying and increasing its dividend if it is generating sufficient income to support it. A wealth management expert can provide personalized advice tailored to your unique financial goals and risk tolerance, ensuring that you make the most of your investment opportunities. InvestingPro offers detailed insights into companies’ Payout Ratio including sector benchmarks and competitor analysis. Note that in the simple interview question above, we’re assuming that the funding for the dividend payout came from the cash reserves belonging to the company, rather than raising new debt financing to issue the dividend(s).