The dividend irrelevance theory, proposed by economist Merton Miller and Franco Modigliani, suggests that the dividend payout ratio does not affect the value of a company or investors’ wealth. According to this theory, investors can create their desired dividend streams by selling shares if dividends are low or reinvesting dividends if they are high. It is up to the investor to decide what kind of dividend payout ratio is most attractive to specific investing needs. A dividend-focused investor may need steady cash income for living expenses, which means the investor’s investing priorities are less concerned with capital gains. Another type of investor will be more focused on capital gains, so this investor will look for a lower dividend payout ratio with an outlook towards growth. The more mature, established companies do not focus on such growth, so they will be more willing to pay the higher dividends.

What is the relationship between dividend payout ratio and corporate growth?

Oil and gas companies are traditionally some of the strongest dividend payers, and Chevron is no exception. Chevron makes calculating its dividend payout ratio easy by including the per-share data needed in its key financial highlights. For example, a company that paid $10 in annual dividends per share on a stock trading at $100 per share has a dividend yield of 10%. You can also see that an increase in share price reduces the dividend yield percentage and vice versa for a price decline. The dividend payout ratio is the ratio of total dividends to net profit after tax. InvenTrust Properties has been paying dividends for the last five consecutive years.

Company B: Low Dividend Payout Ratio

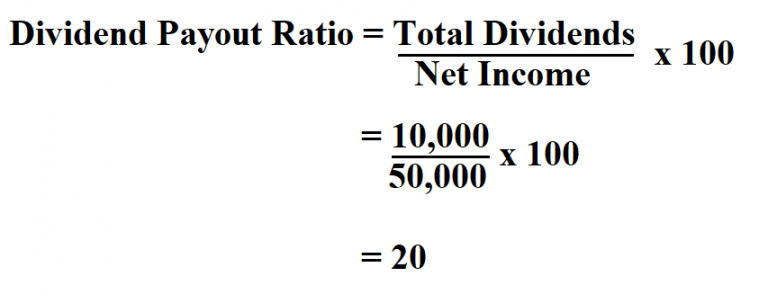

For example, if a company issued $20 million in dividends in the current period with $100 million in net income, the payout ratio would be 20%. The purpose of paying out turbotax news and articles dividends is to incentivize investors to hold shares of a company’s stock. The dividend payout ratio reveals a lot about a company’s present and future situation.

- After a consistent period of having a dividend payout ratio over 100%, WWE had to cut its quarterly dividend payment from 36 cents per share to 12 cents per share in June of 2011.

- Meanwhile, a higher ratio might show that a company is giving more profits back to its shareholders as dividends.

- It may vary depending on the situation but overall a good payout ratio on dividends is considered to be anywhere from 30% to 50%.

- Also, higher dividend payments imply less money to fund business development initiatives and seize growth opportunities.

- For instance, a consistent or increasing payout ratio can be a positive signal for income investors, who may see it as an indication of reliable, ongoing dividend payments.

Company’s Growth Stage

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. InvenTrust Properties’s dividend yield is less than the Real Estate sector average. InvenTrust Properties’s last regular dividend was on Sep 30, 2024 (ex-date) with the amount of $0.226 per share.

Historically IVT’s dividend yield has averaged at 3.0% in the last 5 years, which is in line with the current one. As such, the ratio helps investors determine whether a company is a good fit for their overall investment strategy–goals, portfolio and risk tolerance. Here, we can reasonably assume that the business will continue distributing 20% of its profit to the shareholders going forward.

Investors and analysts use the dividend payout ratio to determine the proportion of a company’s profits that are paid back to shareholders. The items you’ll need to calculate the dividend payout ratio are located on the company’s cash flow and income statements. In any case, investors expect a timely announcement and clear explanation of any changes in dividend policy, especially when dividend cuts are concerned. One of the key reasons is that dividend-paying stocks are an important fixed-income component of many individual and institutional investment portfolios. Within this framework, management faces the pivotal decision of optimizing the balance between earnings distribution and retention for continued expansion. It becomes a strategic tool aiming to align the interests of a diverse investor base—from those seeking immediate profits through dividends to those who value reinvestment of earnings for long-term capital gains.

As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability. In conclusion, understanding the Dividend Payout Ratio is crucial to building a profitable investment strategy. Certain financial information included in Dividend.com is proprietary to Mergent, Inc. (« Mergent ») Copyright © 2014. This could lead to a vicious cycle of stock declines that a company might not be able to escape from.

A company with a high payout ratio indicates a substantial portion of earnings is being paid as dividends. These dividends are a crucial source of steady income for income-oriented investors who prioritize regular income over long-term gains. Alternative metrics, such as the free cash flow payout ratio or the dividend coverage ratio, provide additional perspectives on a company’s ability to sustain dividend payments and invest in future growth.

Dividends are earnings on stock paid on a regular basis to investors who are stockholders. In short, there is far too much variability in the payout ratio based on the industry-specific considerations and lifecycle factors for there to be a so-called “ideal” DPR. An important aspect to be aware of is that comparisons of the payout ratio should be done among companies in the same (or similar) industry and at relatively identical stages in their life cycle.