First, it makes it possible to reconcile the records of the bank with the records of the account holder. For businesses that must pay taxes on the outstanding balances within their cash accounts, knowing how much cash is actually present as of a certain day makes it much easier to calculate those taxes. In any situation, the book balance as of a specific date serves as a starting point to determine where discrepancies have occurred since, and make it possible to correct those accounting issues. Usually, book balance is employed to control the finances in a business’s checking account. The book balance and bank statement are compared at the conclusion of an accounting period to see if the amount of money in the bank account equals the book balance.

- Regularly monitoring and reconciling the book balance with the bank statement balance helps ensure accuracy in your financial records and enables you to detect any errors or discrepancies.

- A store owner once noticed a huge difference between their bank and book balance during monthly reconciliation.

- This lets you know if there are any errors in your record-keeping, which you can fix now rather than at the end of the year when it’s more difficult to do so.

- If a check included in a deposit had insufficient funds, the bank would withdraw that money out of the company’s checking account.

- Additionally, automated payments or direct debits scheduled by the company might not align perfectly with the bank’s processing times, further contributing to timing-related discrepancies.

Would you prefer to work with a financial professional remotely or in-person?

Banks would obviously show only those checks on the bank statement that have actually been presented to them and paid by them on behalf of the account holder. In practice, the balance in the cash book rarely agrees with the balance in the bank statement. A few examples of transactions that are reflected in the bank balance but not the cash amount are service fees, interest income, and returned checks. In personal finance, an investment’s carrying value is the price paid for it in shares/stock or debt.

- The source of bank statement entries is cheques deposited by customers, payments made to suppliers by issuing a draft or check.

- Discrepancies can bring serious issues like wrong financial statements and possible legal problems.

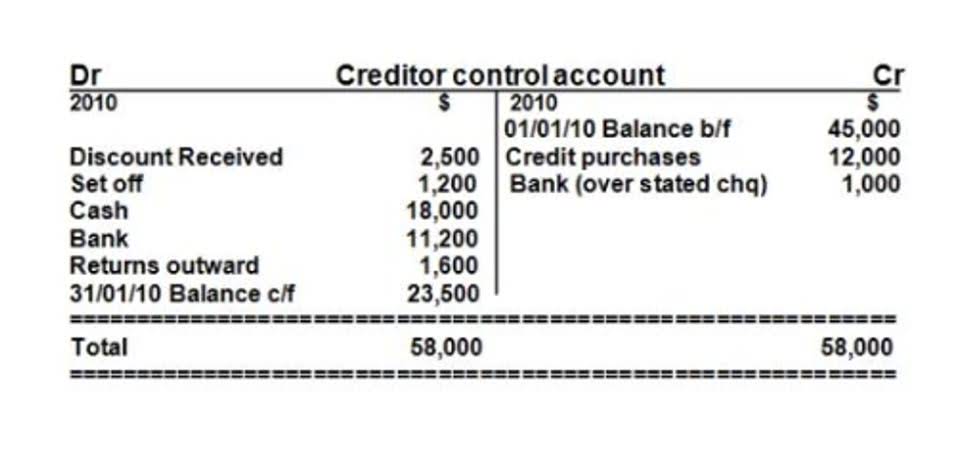

- Balance, the last column shows ‘Cr.’ Alternatively, if the balance is a Dr. balance, the last column shows ‘Dr.’ An example of a typical bank statement is shown below.

- Implementing robust measures for financial oversight and compliance is crucial to rectify the situation.

- For instance, if you issued checks towards the end of the month, those likely will not have cleared by June 30.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- A company’s bank account may have had account service fees debited out of it during the month and at the end.

Causes of Disparities in Balances per Cash Book and Bank Statement

In this case, the cash account book balance reflects the net result of deposits, withdrawals, and other financial activities during the month. Regularly monitoring and reconciling the book balance with the bank statement balance helps ensure accuracy in your financial records and enables you to detect any errors or discrepancies. A bank reconciliation statement can be prepared to summarize the banking activity for an accounting period to be compared to a company’s financial records and book balance.

Comparing the Bank Balance and Book Balance

The bank would deduct the monies from the company’s checking account if a deposit check did not have sufficient funds. Book balance and bank balance may differ as book balance includes all recorded transactions, while bank balance only reflects the amount of funds available in a company’s bank account at a specific time. By leveraging accounting software, Bookkeeping for Chiropractors businesses can streamline the recording and tracking of financial transactions, which in turn facilitates easier reconciliation processes.

- Knowing the book balance as of a specific date is important for several reasons.

- The book balance is derived from a company’s ledger and reflects all financial transactions, including sales, expenses, and any other monetary movements, as recorded by the organization.

- The carrying value of an asset is its net worth—the amount at which the asset is currently valued on the balance sheet.

- In case the value obtained is negative, it means that the asset has a net loss or it can be said that its losses exceed its profits, thus making it a liability.

- Interest earned on an account is often paid on a company’s cash balance and is credited to the bank account at the end of the month.

- A bank balance is the ending cash balance appearing on the bank statement for a bank account.

The term is most commonly applied to the balance in a firm’s checking account at the end of an accounting period. An organization uses the bank reconciliation procedure to compare its book balance to the ending cash balance in the bank statement provided to it by the company’s bank. When any of these differences have already been recorded in the company’s records but not those of the bank, they are itemized as reconciling items on the bank reconciliation.

Cash Book and Bank Statement FAQs

Often the book balance at June 30 will not be the true what is book balance amount until some items on the bank statement are recorded. For instance, if you issued checks towards the end of the month, those likely will not have cleared by June 30. In that case your book balance will be lower than the bank balance due to the uncleared transactions. Book balance and bank balance are two distinct figures that often require careful examination to ensure financial accuracy.

- These might include incorrect charges, duplicate transactions, or errors in processing deposits.

- Before looking for issues, make sure you haven’t listed the same entry twice or overlooked to record it in either column.

- For instance, a company may write a check and record it in its books immediately, but the bank may not process this check until a few days later.

- Reconciling bank balance and book balance is also key for financial planning and budgeting.

- It’s important to ensure that each transaction is accurately recorded in both the bank’s records and the company’s accounting system.

Ask a Financial Professional Any Question

You will use the beginning balance on the bank statement as your starting balance in Aplos. As a result, Company ABC must keep contribution margin track of its pending debits and credits to manage its cash flow activities to ensure it has enough funds to operate. Such anomalies are frequently noticed because of delays in transaction processing and ignorance of some costs that the bank has credited to the corporate account. To reconcile a company’s financial records and book balance with the banking activity for an accounting period, a bank reconciliation statement can be created. One of the primary reasons for differences between these two balances is the timing of transactions. For instance, a company may write a check and record it in its books immediately, but the bank may not process this check until a few days later.

The source of bank statement entries is cheques deposited by customers, payments made to suppliers by issuing a draft or check. When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account. Similarly, when a check is issued to a supplier, an entry is made in the bank column on the credit side of the cash book. The account holder may, in many cases, learn of such a direct deposit only on receipt of their monthly statement. Bank balance, however, is the actual amount of money in an account from the bank’s view. It considers all cleared transactions like deposits, withdrawals, and fees.

Reconciling bank balance and book balance is also key for financial planning and budgeting. Accurate financial records enable businesses to forecast future cash flows well, make strategic investments, and plan for possibilities. Without proper reconciliation, businesses may not know how much money they have, leading to wrong budgets and bad decisions. The balance on June 30 in the company’s general ledger account entitled Checking Account is the book balance that pertains to the bank account being reconciled. This is the case when there are bank fees or electronic transfers on the bank statement that have not yet been recorded in the company’s general ledger accounts.